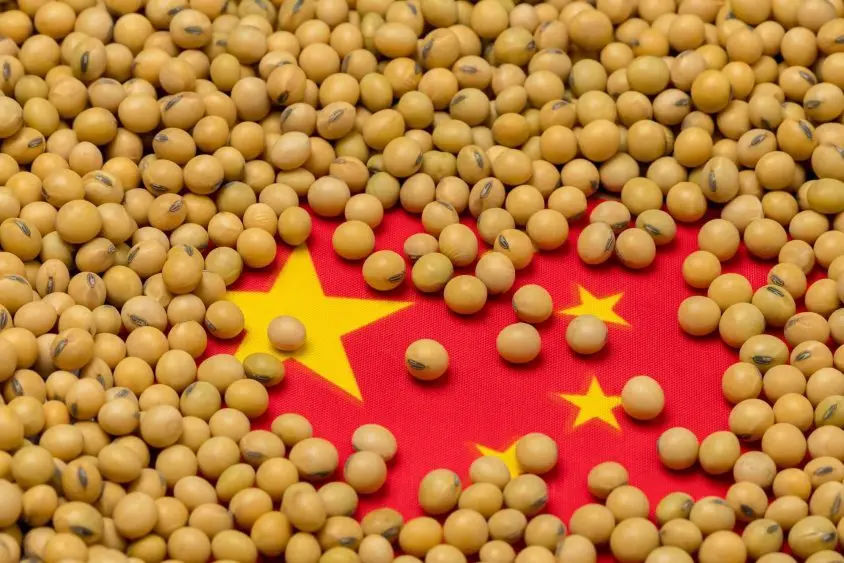

(DECATUR, IL) — The world’s top soybean importer, China, doesn’t seem to have bought a single American cargo ship’s worth of soybeans for the coming marketing year (which starts September 1st). And that lack of buying has cash prices struggling to get above $9 in some areas as farmers feel the pinch of high input costs and an overall cost price squeeze.

As of Thursday, many areas in the Northern Plains were seeing cash bids for soybeans well under the price at the board of trade. Many cash bids in North Dakota ranged anywhere from $1.20 to $1,60 below the board with many areas seeing $8 and change soybeans. One example was a cash price of $8.87 in Valley City, ND.

U.S. government data shows Chinese buyers are standing pat on U.S. soybeans while the two countries continue to negotiate an end to the trade hostilities that have upended commodity markets. America’s soybean farmers have told the White House that the current stalemate has them hanging on the edge of a financial precipice. China imposed retaliatory tariffs on American soybean imports in March, making the cargoes less competitive in the Chinese market.

During the Farm Progress Show this week in Decatur, IL, American Soybean Association President Caleb Ragland shared that they continue to talk with administration officials about the current economic crisis unfolding in farm country. That included a visit with USDA Deputy Secretary Stephen Vaden, who attended this week’s event in Illinois. “It’s kind of the chicken or the egg effect,” said Ragland. “But the reality is both are serious and both are having a very detrimental effect on American agriculture. And our soybean industry in particular is in a very tough spot with the lack of sales to China, which is because we’re uncompetitive due to the 20% retaliatory tariffs.”

Ragland continued “And we talked with the Deputy Secretary about the importance of trade and the importance of getting that message conveyed to President Trump and his trade team. And that message is being delivered. In fact, they had a cabinet meeting yesterday and there were several pieces of information that had been compiled by USDA that were brought up in that meeting, highlighting the situation with the farm economy, highlighting the trade situation. And I mean, the numbers would tell you that over the last five years on average, just under 10% of the whole U.S. soybean crop is normally on the books sold to China at this point. And right now there’s zero. And you’re seeing the effect of that in basis in the Dakotas in particular, I’ve heard stories as bad as $1.60 under. And with already low commodity prices, that makes it even worse. And we have a revenue problem that is going to really bite a lot of our farmers when it comes into the year and time to pay off operating notes and get plans finalized for the 26 crop, because right now the math doesn’t add up. The vast majority of farmers are in the red, especially soybean producers and row crop producers in general.”

Chinese mills that crush the oilseed into animal feed will usually book ahead to take advantage of cheaper prices and ensure their needs are met for the first few weeks or months of the crop year. However, Bloomberg reports, that Chinese soy crushers may go through the winter without any U.S. beans due to the current trade war situation between the two countries.

Ragland added that when it comes to the economic situation in farm country, he says “we’ve really got a reckoning we’re gonna have to have to figure out how to both reduce our cost and get our income increased.” But he says farmers as resilient.

“Farmers are a resilient group. We’re a tough group that has seen hard times before. The bottom line is, we want our farms to be profitable, and we’ve got to be sustainable. And that includes financial things. And my family, just like 1000s and 1000s of others is 100% dependent on our farm to make a living. We have to be profitable. I have to answer to my banker, that this is a business that is viable for them to trust in and loan money to year in and year out, we have bills we have to pay back. And that is the reality that we’re facing. And we need to be profitable.”

Hear the full conversation with Ragland below: