Rising input costs for farmers has been an issue the Trump administration has made a policy priority as it advances through its first year – and with good reason. Soybean producers are staring down the barrel of a third year of negative market returns.

Soybean growers find themselves in a precarious position as the 2025 harvest season wraps up. When harvest began in September 2025, November futures prices were between 25% – 30% lower than at the same point in 2022. The lower revenue levels limit the amount of liquid assets farmers have available to pay off 2025 expenses this fall.

It’s not just the revenue side of the income statement where soybean farmers are being squeezed. Farmers are facing elevated prices for land, machinery, seeds, pesticides and fertilizers. According to USDA, farm production expenses are expected to reach $467.4 billion for 2025 – a $12 billion increase over 2024.

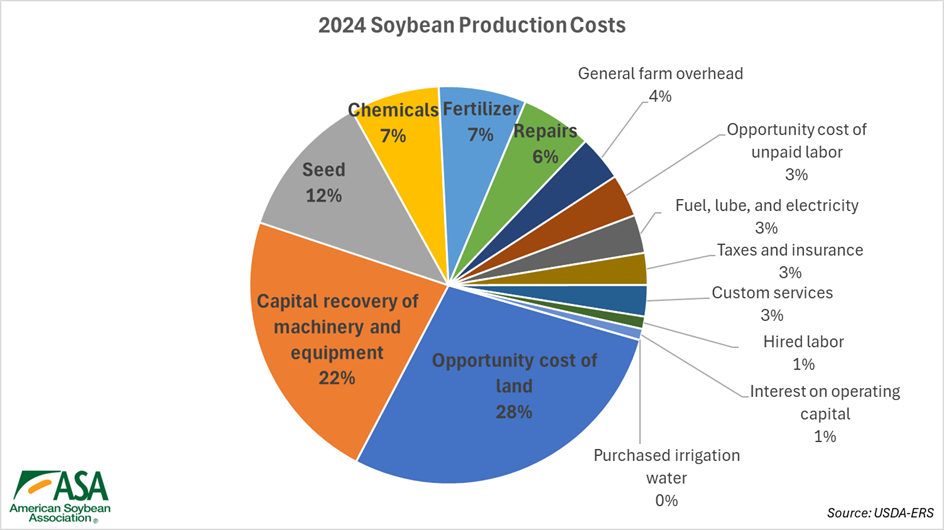

According to annual soybean cost of production reports published by USDA’s Economic Research Service (ERS), land (28%), machinery and repairs (28%), seeds (12%), pesticides (7%), and fertilizers (7%) are the most critical inputs for soybean production and account for 83% of a soybean operation’s annual expenses per planted acre.

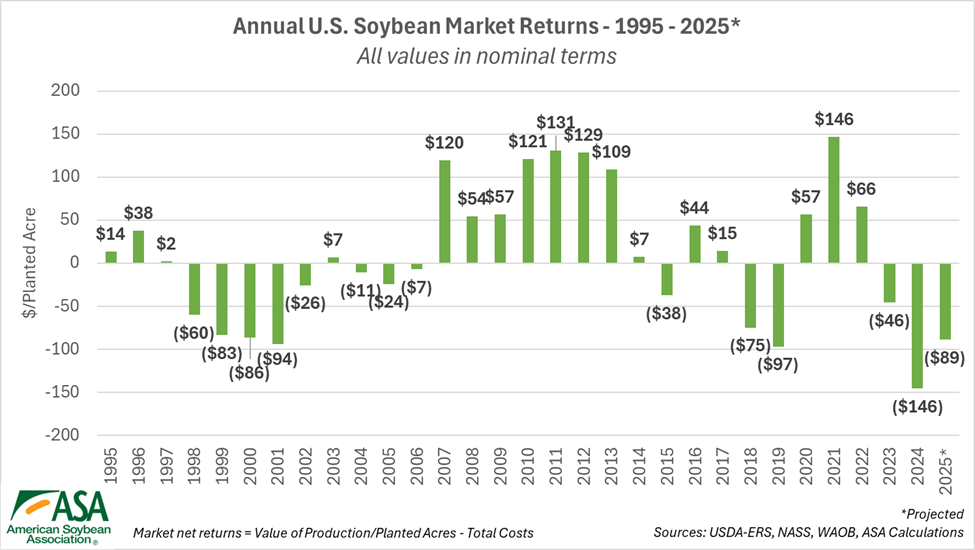

The rising input costs mean farmers are paying more than ever to grow their crops, often at a loss. An ASA economic analysis projects soybean farmers will net an $89 per planted acre market loss on their 2025 crops.

Anticipated 2025 losses will mark a third consecutive year of market losses for U.S. soybean producers. USDA’s Economic Research Service (ERS) expects 2026 input costs to remain at elevated levels. Unless revenues increase significantly next year, this would squeeze farmgate profits for a fourth year, marking the longest stretch of substantial soybean production losses since ERS’s 1998 – 2002 reporting period.

Previous analysis from the American Soybean Association has focused on revenue threats and opportunities for soybean prices. This analysis explores the rates of input expense increases as well as the complex and global underlying factors pushing prices higher.

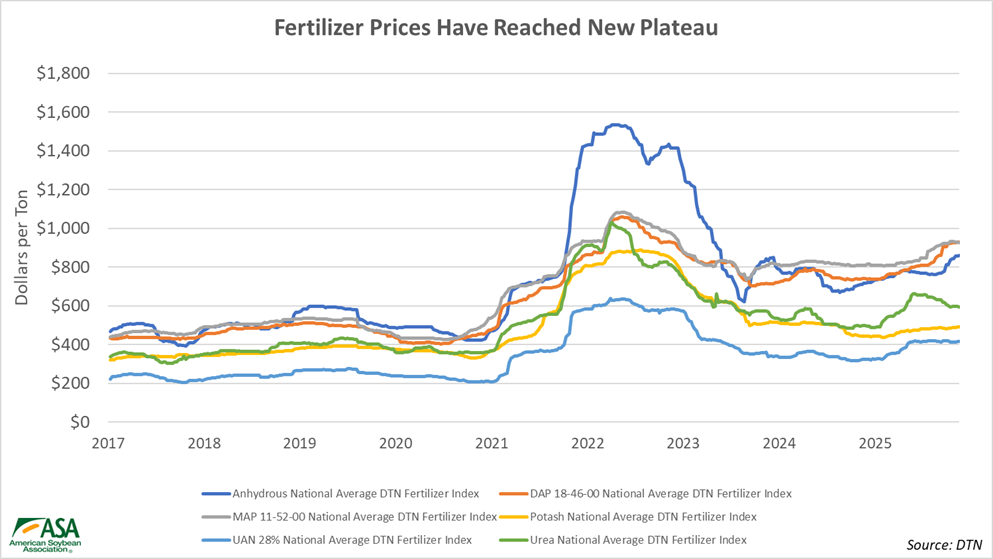

Price escalation

The COVID-19 pandemic kicked off an era of price turbulence in input markets which has not subsided over the past five years. Due to record prevented plant acreage in 2019, some input supplies were stockpiled and prices for some products dropped to record lows in 2020 due to the excess inventory as well as lackluster crop prices during the 2018-2019 trade war.

Some input production was scaled back ahead of the 2020 season to account for higher supplies and lower prices. But the one-two punch of pandemic supply chain issues and crop shortfalls pushed demand for inputs, therefore prices, higher ahead of the 2021 season.

Read the full report and analysis from Holland and Gerlt here: https://soygrowers.com/news-releases/the-rising-cost-squeeze-soybean-farmers-face-a-third-year-of-losses/